Disney ‘Warns’ of Attendance Slowdown

Disney recently reported its second quarter fiscal 2024 earnings, with the company's Experiences (Parks & Resorts + Consumer Products) reporting $8.3 billion in revenue. This covers the good & bad of these results as they

Disney recently reported its second quarter fiscal 2024 earnings, with the company’s Experiences (Parks & Resorts + Consumer Products) reporting $8.3 billion in revenue. This covers the good & bad of these results as they relate to Walt Disney World & Disneyland, and why despite the strong performance for parks, CEO Bob Iger is warning investors of an attendance slowdown…and what that actually means.

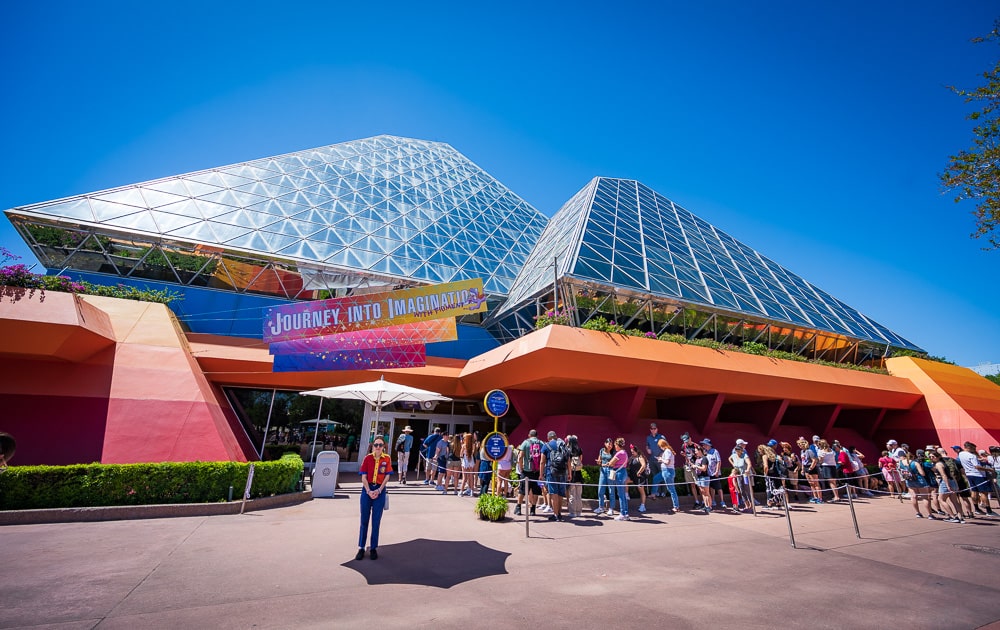

During the main presentation, Disney CFO Hugh Johnston shared that this quarter’s growth was driven by growth of Disney Cruise Line and Walt Disney World on the domestic side, with Hong Kong Disneyland outperforming among the international side. With regard to HKDL, this makes a lot of sense. Hong Kong is undoubtedly seeing lagged pent-up demand since it reopened slower, meaning it has easier comparisons from the last couple of years. Add the new World of Frozen to the mix, and HKDL is likely to outperform for the next few years. As that little park has struggled for so long, we love to see it doing so well that it warrants mentioning on the earnings call.

Walt Disney World is the biggest surprise, as I believe this is the first earnings call in over a year with it being mentioned as a bright spot. For the last several calls, Disneyland was outperforming and Walt Disney World was weakening. Now, the opposite is true. Johnston also indicated that Disneyland’s results declined despite growing attendance and per-capita guest spending, due to cost inflation and higher labor expenses.

Looking forward, Johnston also said that although consumers continue to travel in record numbers and Disney is still seeing healthy demand as a result, the company is starting to see some evidence of a global moderation from peak post-COVID travel. He seemed fairly unfazed by this, noting that next quarter won’t see much growth, but largely due to one-offs like Disney Cruise Line launches (Lighthouse Point and the new ships), with higher labor costs and the aforementioned post-pent-up demand normalization also playing a role.

Despite this and demand impacts, Johnston expects year-over-year Disney Experiences operating income growth to rebound significantly in the fourth quarter due to “fewer comparability or timing factors.” That doesn’t exactly sound like the company is concerned about the Parks & Resorts business.

However, during the Q&A, CEO Bob Iger struck a slightly different tone. He was asked about his expectation for attendance after lapping COVID, and whether that would stabilize or soften into fiscal year 2025. Specifically, whether trends would be sufficient to expect attendance to have any kind of year-on-year decline?

“In terms of attendance, what we’re basically communicating is relative to the post-COVID highs, things are tending to normalize. The parks business did 10% growth in the quarter. And obviously, that’s an extremely high revenue number. That said, we still see in the bookings that we look ahead toward indicate healthy growth in the business. So we still certainly feel good about the opportunities for continued strong growth,” Iger explained.

“I certainly feel like the Parks business is still doing very, very well. Obviously, we’ve got the best in the business in terms of product. And people still have a strong desire to basically go on vacation and come to see us.”

If all of this sounds familiar, it should. This also isn’t the first, second, or even third time the company has directly addressed it and indicated that pent-up demand has been exhausted at some of the parks. No, the parks are not dead or ghost towns or totally empty, but they’re down as compared to the height of pent-up demand.

None of this is particularly surprising. We’ve been documenting the slowdown in crowds at Walt Disney World, which started last year following spring break. However, that trend reversed itself in early 2024! When the first two months were busier than expected, we started discussing Re-Revenge Travel at Walt Disney World in 2024. We’ve theorized there’s a second wave or reverberation of pent-up demand after every month last year after January was down as compared to 2022.

These results corroborate that, at least in part. Walt Disney World outperformed in the most recent quarter after being a laggard for the last year-plus. So why did Iger and Johnston make those comments about declines and normalization due to the exhaustion of pent-up demand? Most likely because the Parks & Resorts business is a lot more than just Walt Disney World.

As a reminder, this is something that dearly-departed CFO Christine McCarthy braced investors for exactly this during the same earnings call one year ago, in May 2023: “Please keep in mind that in the back half of this fiscal year, there will be an unfavorable comparison against the prior year’s incredibly successful 50th anniversary celebration at Walt Disney World. We typically see some moderation in demand as we lap these types of events, and third quarter-to-date performance has been in line with those historical trends.”

That warning came true, and Walt Disney World underperformed last year as every other park continued to outperform. Executives mostly attributed this to timing, indicating there was a drop in demand at the Florida parks even as Disneyland and international parks’ attendance stayed strong. This was because Disneyland reopened a year later than Walt Disney World. That along with every other destination experienced delayed pent-up demand as compared to Walt Disney World, since Florida reopened sooner than…pretty much everywhere.

Now, the opposite appears to be happening. Just like Walt Disney World “lapped” the 50th at this time last year and was thus facing unfavorable comparisons right as pent-up demand began exhausting itself, it has now once again lapped those weaker numbers and has easier comps. By contrast, many of the other parks–including Disneyland–find themselves in the same position that Walt Disney World was in one year ago.

None of these numbers are static–they’re all relative to the prior-year, which is a time when Walt Disney World was doing “worse” (as compared to the year before that), whereas Disneyland and the international parks were doing “better” (also as compared to the year before that). If we just zoom out a bit, the picture becomes prettier for all of the parks.

In other words, don’t feel too badly for Disney during these trying times of normalizing attendance and demand. Walt Disney World and every other destination is still performing well above pre-COVID levels–with revenue, operating income, and per guest spending all up considerably at every destination as compared to fiscal year 2019.

This is starting to normalize, as Disney has had to pull more “levers” to entice guests to visit. And by that, we largely mean better discounts. As we’ve mentioned repeatedly, Walt Disney World has pulled out the 2019 deal playbook for 2024. It’s basically back to normal on the deal front, and most of these discounts have been released earlier than normal by historical standards, and offer better savings than their counterparts from the last two years. Some are superior to 2018 or 2019, but baseline prices and perks have also changed since then.

It’s not just room-only rates or Free Dining to drive up occupancy. Walt Disney World also brought out the 4-Park Magic Ticket, V.I.PASSHOLDER Days, and more in an attempt to give demand a shot in the arm and buoy bookings. Discounts accomplish that, but they typically do so at the expense of higher per guest spending. Still, we’re talking about a decrease relative to the height of pent-up demand in 2022–pretty much everything is still up considerably as compared to the 2019 baseline.

Ultimately, the ‘warnings’ of Disney CEO Bob Iger and CFO Hugh Johnston were measured because the situation is still far from dire for the Disney Parks. This will be painted as a five-alarm fire by those cheering for Disney’s downfall, but that’s not reality. Especially not at Walt Disney World when compared to last year, which is what matters to most of you.

It’s still possible the Florida parks are down this summer as compared to last, but I wouldn’t bet on it. Anyone just now covering declines at Walt Disney World is literally over a year late to the party. That started in February 2023, became really noticeable in mid-April 2023, and continued for the remainder of last year. The monthly trend in 2024 (minus April) has stabilized or increased.

This year, the slowdown is going to disproportionately occur at Disneyland and the international parks (seemingly minus Hong Kong), as they were slower to see pent-up demand arrive and are now on the backside of that. Regardless, a slowdown from unprecedented demand is not a catastrophe, it’s a normalization. Of course, Disney would’ve loved to maintain record-breaking numbers or that growth trajectory, but even internally, they knew a slowdown was on the horizon.

All of this is what we’ve been expecting and hoping to see for a while. Pent-up demand lasted longer than anticipated, and frankly, it was a distortion that had unhealthy consequences for the broader economy (beyond Disney). Putting that in the rearview mirror may be bad for the company, but it’s good for consumers and the country as a whole.

I’m not a doomer grasping at straws looking for Disney’s downfall, but honestly, I hope that even Walt Disney World sees a decline (in attendance, revenue, per guest spending–all of it!) in the quarters to come. The numbers are still way up as compared to 2019, even assuming a healthy growth trendline. Disney not doing record-breaking numbers regardless of the guest-unfriendly decisions they make–and instead having to actually compete for customers and make positive changes–is a good thing!

Frankly, I don’t know why there’s this desire to paint that as a negative, when it should be construed as good for consumers and guests. As with the arrival of Epic Universe, it seems that disgruntled former fans want to see Disney taken down a notch and are engaged in a lot of completely unmoored wishful thinking. While I’d welcome even more of a “normalization” to bring numbers closer to 2019, I don’t want to see too much of a drop. The last thing the company needs before the blockbuster D23 Expo is seeing negative results out of Parks & Resorts that spook them out of announcing plans for the $60 billion investments.

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What do you think of the Walt Disney Company’s ‘warning’ that attendance is going to normalize in the post-pent-up demand environment? What about per guest spending at Walt Disney World and Disneyland, or other theme park results? Thoughts on a slowdown at Walt Disney World or Disneyland? Predictions about other “levers” the company will pull to boost demand and buoy bookings? Think things will improve or get worse throughout this year? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!